To connect this service to enterprises, organizations, individual entrepreneurs, it is required to perform the following actions:

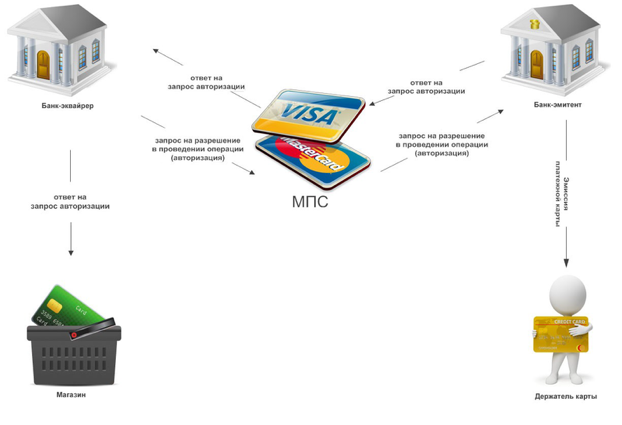

The procedure for registration of an enterprise (seller) in the processing center of the National Bank for e-Commerce services on international Visa cards and payment procedure.

1. The company applies to the National Bank to conclude the Contract for e-Commerce services for the cards of international payment systems via the Internet.

2. The Bank sends the copy of contract concluded and required documents to the processing center of the National Bank.

3. The processing center opens a transit currency account for the enterprise and registers it. After registration, the processing center provides the enterprise with Merchant_ID and Terminal_ID, as well as instructions for connecting to the National Bank e-Commerce website plugin.

4. On its web-site, the enterprise creates section to receive payments via Visa/MasterCard and describes the procedure specifying that the web-site of the enterprise is redirected to the NBU website when entering the details of Visa / MasterCard cards by the payer. After payment, the payer returns to the web-site of the enterprise reflecting a message about the success / failure of the payment.

5. The bank transfers the proceeds of the enterprise to its foreign currency account. When transferring funds, a bank commission is charged according to the Commission fees for servicing legal entities and individuals, and as a result, the company receives revenue minus this commission.

6. The funds on the currency account shall be used in accordance with the currency control regulatory and legislative acts of the Republic of Uzbekistan.